This compact and concise study provides a clear insight into the concepts of Core Banking Solution (CBS)—a set of software components that offer today’s banking market a robust operational customer database and customer administration. It attempts to make core banking solution familiar to the professionals and regulatory authorities, who are responsible for the control and security of banks, and shows that by using CBS, banking services can be made more customer friendly.

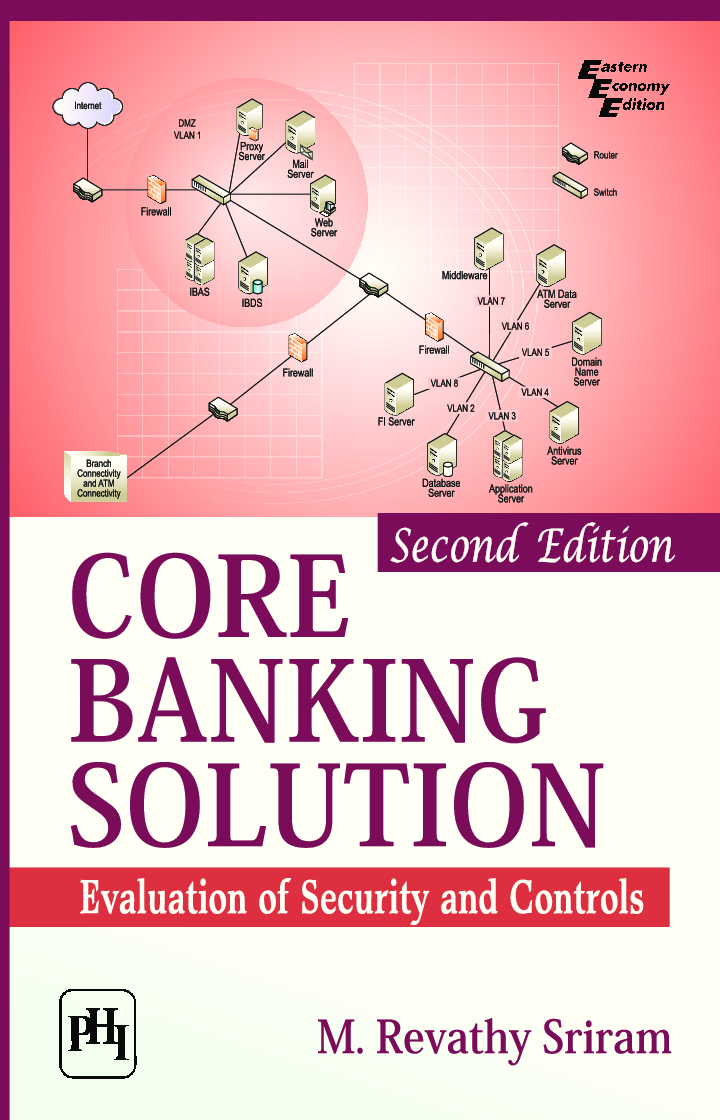

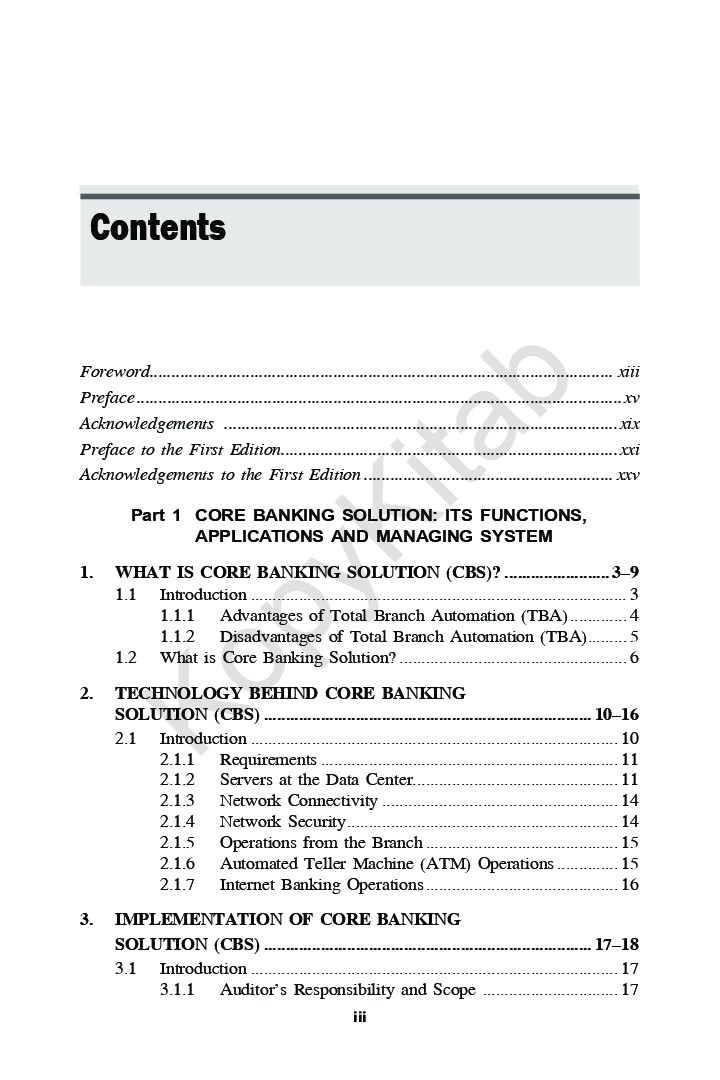

This well-organized text, divided into two parts and five sections, begins (Part I) with the need for core banking solution technology in banking system, its implementation and practice. It then goes on to a detailed discussion on various technology implications of ATM, Internet banking, cash management system and so on. Part I concludes with Business Continuity Planning (BCP) and Disaster Recovery Planning (DCP).

Part II focuses on components of audit approach of a bank where the core banking solution has been in operation. Besides, usage of audit tools and study of audit logs have been discussed.

The Second Edition includes new sections on outsourcing of ATM operations, printing of ATM card, printing of Pin Mailers, mobile banking, Point of Sale (POS), financial inclusion, vulnerability assessment, penetration testing and so on. Besides, many topics have been discussed extensively and updated to make the book more comprehensive and complete.

This book Useful for Management students.

Part 1—Core Banking Solution: Its Functions, Applications and Managing System.

1. What is Core Banking Solution (CBS)?.

2. Technology Behind Core Banking Solution (CBS).

3. Implementation of Core Banking Solution (CBS).

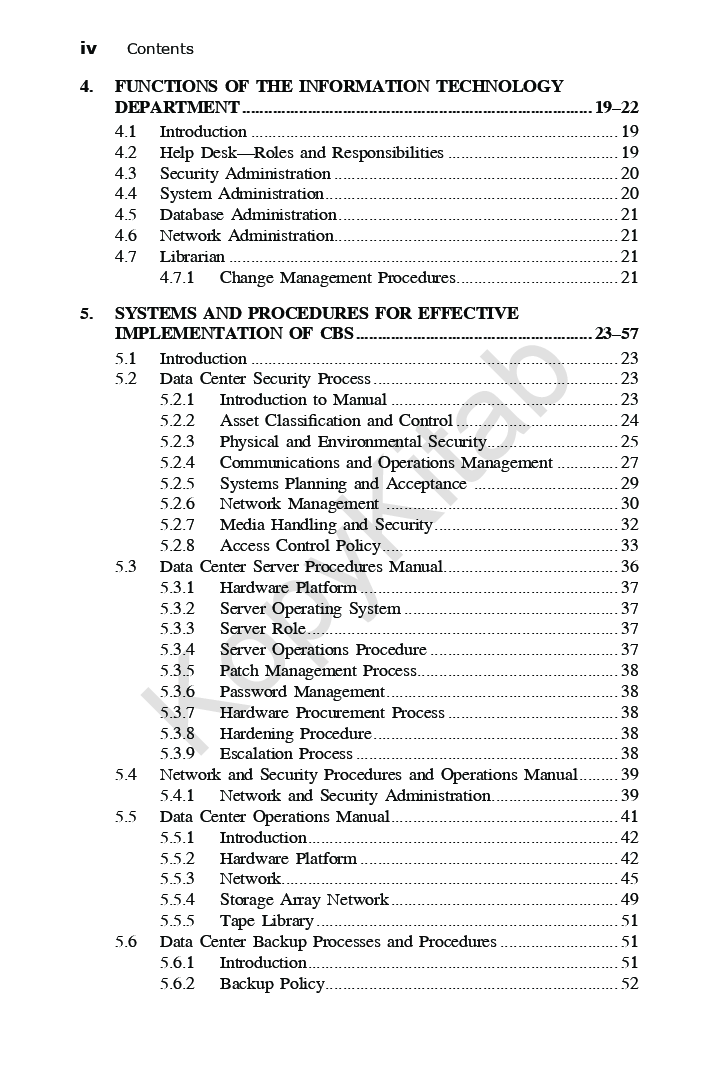

4. Functions of the Information Technology Department.

5. Systems and Procedures for Effective Implementation of CBS.

6. Application Program Modules and Their Functionality.

7. Activating the Branches.

8. ATM Functionality—How it works.

9. Internet Banking, Real Time Gross Settlement, Cash Management System, Mobile Banking Services, Point of Sale and Financial Inclusion.

10. Security Policy.

11. Business Continuity Planning (BCP) and Disaster Recovery Planning (DRP).

Part 2—Evaluation of Security and Control.

12. Scope of Evaluation of Security and Controls in a Core Banking Solution.

13. Review of Security Policy Implementation.

14. Review of Business Continuity Planning and Disaster Recovery Planning.

15. Systems Development and Change Management.

16. Network Security.

17. Evaluation of Controls in Operating System.

18. Testing of Application Modules of Core Banking Solution.

19. Evaluation of Controls in ATM Operations.

20. Evaluation of Controls in Internet Banking.

21. Evaluation of Controls and Audit of Branches.

22. Review of System Logs.

23. Audit Tools.

24. Instances of Frauds, Its Causes and Controls.

25. Relevant ISACA Standards, Guidelines and Procedures.